The Dark Side of Valuation: The power of smug

One of the chief benefits of value investing is the pleasant feeling of smugness it incites in its practitioners. The impression created among value investors is that we are really the only people who know or care about valuation or fundamental analysis, or who have the slightest hope of achieving long-term investment success. Well, on Wall Street at least, because the high pay and unpleasant working conditions and in some cases the tournament-style hiring and promotion practice, careers tend to be pretty short. But Montier points out that everyone he knows who has lasted decades as a portfolio manager on Wall Street has done so as a value investor. And the psychic pleasure in knowing that is surely just as good as the financial rewards.

So, with this in mind, I thought I would review Damodaran’s Dark Side of Valuation, a book about how naively the typical analyst approaches difficult-to-value firms and all of the shortcuts they take. I am pleased to see people taking a critical eye to the sloppy practices of some analysts, but at the same time I’m not sure that his approach will solve the problem. For example, when dealing with startups, he advises that one possibility is working backwards from the mature company, estimating that the target market is, say $200 million a year and the firm under consideration, when it grows to a mature size, will capture 10% market share, and then to map out the course the company will take in order to reach maturity, and then apply a large discount rate to deal with the very likely possibility that the firm will fold or be acquired first.

So, with this in mind, I thought I would review Damodaran’s Dark Side of Valuation, a book about how naively the typical analyst approaches difficult-to-value firms and all of the shortcuts they take. I am pleased to see people taking a critical eye to the sloppy practices of some analysts, but at the same time I’m not sure that his approach will solve the problem. For example, when dealing with startups, he advises that one possibility is working backwards from the mature company, estimating that the target market is, say $200 million a year and the firm under consideration, when it grows to a mature size, will capture 10% market share, and then to map out the course the company will take in order to reach maturity, and then apply a large discount rate to deal with the very likely possibility that the firm will fold or be acquired first.

The trouble, from a defensive, value investing standpoint, is the issue of garbage in, garbage out. Damodaran deserves credit for reminding us that growth for companies has to come from capital reinvestment, and that there is a limit to growth, but at the same time it is well known that analysts are unable to forecast last year what will happen this year, and so it would be better for them not to try. As a result, it is a very bold assumption to map out earnings and reinvestment for many years into the future.

And yet, isn’t that what value investors do? Yes and no. The effective value investor makes realistic projections of a firm’s earnings power, not its actual earnings, and with a very conservative view of growth (my personal preference is not to project growth at all). But a company reinvests its earnings, not its earnings power, so the projectionist method is quite suspect. Generally, the value investor cannot find any value in startups or high growth companies without giving in to fatal optimism. Damodaran also embraces beta (the volatility of a stock relative to its index) as a useful measure of risk or input into valuation, when beta in many cases has only a tenuous relationship to the riskiness of an investment.

However, Damodaran’s book is a step in the right direction, giving readers sobering insights that growth is never free, that emerging market companies look cheap because of the risks of investing in them, and that growth cannot persist forever. He also recommends that the way to value stock options is to actually value them with an option valuation model and subtract that amount from the equity, taking into account how people tend to exercise these options early. His book is larded with useful statistical analyses, and one of the most useful one is an assessment of growth rates for high-growth companies that shows that the next Microsoft is, of course, an unspeakable rarity. Starting from the IPO, he found that the average new company has five years of excess growth before its growth falls in line with its sector’s. And it’s not five good years and then it hits the wall either; the excess growth starts at 15% and declines geometrically, and year 5 is on average only 1% ahead of the sector.

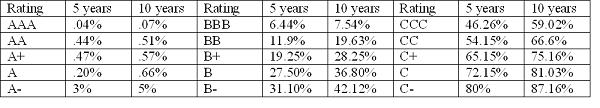

He also included the most useful chart I’ve ever seen, a device that allows investors to estimate the interest rate spread and a synthetic credit rating, from a firm’s interest coverage. This chart appeared in Damodaran on Valuation as well, but this one is more recent. Here it is (all rights reserved to original copyright holders, etc.):

This chart is coupled later in the book with a historical treatment of cumulative default rates, so if an AAA rating 20 years ago meant the same thing it does now (and outside of the mortgage derivatives arena I believe it does) we can look at default possibilities for even unrated, privately placed debt, which is a good thing.

So, I do recommend Dark Side of Valuation, and really Damodaran on Valuation and it together are a good introduction to the basic method of how to analyze companies quantitatively. But it cannot replace Security Analysis or Margin of Safety for identifying definitely underpriced companies. Armed with all of these, you can be as smug as Buffett or Klarman or even Nassim Taleb himself.

[…] to work. To achieve … Read More RECOMMENDED BOOKS REVIEWS AND OPINIONS The Dark Side of Valuation: The power of smug One of the chief benefits of value investing is the pleasant feeling of smugness it incites in […]