An Unsustainable Dividend is no Dividend at all (eventually) (Calumet Specialty Products)

As you may recall, I commented on the dangers of being a yield hog, which is a constant temptation for those of us who seek investments that produce high and sustainable cash flows. Sustainable but not high is not good enough, and high but not sustainable is even worse, because when the cash flow runs out all the other yield hogs will dump the security in question, depressing its price even below fair value. Not surprisingly, just running a stock screener to rank all stocks by yield is inadequate, but it nonetheless can produce candidates that are worthy of further investigation.

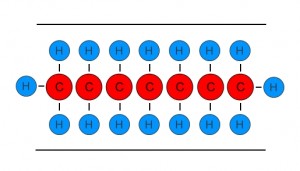

Calumet Specialty Products (CLMT) is an investment partnership that produces various petroleum products. It currently pays a dividend of 12.3%, and has a P/E ratio of 10.68, so it is almost covered. However, their earnings seem to have been fairly variable over the years and sales have been dropping from their heights, so this is probably not a good source of sustainable cash flow, although their dividends have been covered by operating cash flow, if not net earnings, for three of the last four quarters.

Calumet Specialty Products (CLMT) is an investment partnership that produces various petroleum products. It currently pays a dividend of 12.3%, and has a P/E ratio of 10.68, so it is almost covered. However, their earnings seem to have been fairly variable over the years and sales have been dropping from their heights, so this is probably not a good source of sustainable cash flow, although their dividends have been covered by operating cash flow, if not net earnings, for three of the last four quarters.

However, you wouldn’t deduce any of the dividend coverage issues from the partnership agreement. Unlike investing in stocks, where the status of the shareholder is tolerably well known, in partnerships the terms of the partnership agreement must be considered individually before investing. Like LINE’s agreement, they are required to distribute all available cash. However, Calumet’s agreement further requires the distribution of 45 cents per partnership unit every quarter, subject to their credit limit. Furthermore, as the available cash exceeds 45 cents, the general partner takes a larger and larger share of the distribution, from 2% for 49 and a half cents up to 50% of the marginal cash when the distribution exceeds 67 and a half cents. So, where corporate managers are often accused of keeping dividends too low in order to expand the size of their empire, the general partner here could potentially be accused of deliberately starving the company by increasing its own incentive distributions. Of course, there are rules as to what is “available cash,†but there has to be some discretion available.

At any rate, a policy that requires the payment of dividends even when the cash is not earned and has to be borrowed is generally a recipe for disaster. In the 80s companies borrowed money and distributed it to shareholders in an attempt to frighten off the takeover artists, which was a questionable strategic move, but Calumet’s policy isn’t even strategic. It puts them dependent on raising additional capital, either from their lenders or from the public (they did make new offerings of equity in 2007 and 2006). And, since they are under an obligation to pay the 45 cents to the new equity as well, the possibility of a Madoff-like ending (although fraud would not be involved) cannot be ignored. As Benjamin Graham stated in response to a Supreme Court ruling denying relief to holders of preferred stock with noncumulative dividends, it is only what the parties agreed to, and a court cannot just rewrite a contract.

So, if you are looking for a high and sustainable dividend, I suggest looking elsewhere for the moment. Given the number of potential investments out there, compromising our standards of safety for a specific one is unwise.

Nice writing. You are on my RSS reader now so I can read more from you down the road.

Allen Taylor