CSG Systems – Servicer to the Greats

There are many routes to becoming a successful company. The standard one is to provide a desirable product to customers at a profitable price. However, another highly effective approach is to provide an essential service to other companies that are engaged in the above action. CSG Systems International (CSGS) has adopted the latter approach, by handling the customer care and billing services for a number of cable and direct broadcast satellite markets, including such giants as Comcast and Dish Network. Last year, the company also acquired Intec, a U.K. based firm that primarily services the telecommunications industry.

What drew my attention to CSG Systems, though, is its high earings power relative to its price. Setting aside certain nonrecurring events, the company has an impressive earnings yield of over 16% based on 2010 earnings, once its excess cash position has been taken into account.

CSG’s four largest clients are Comcast (24% of 2010 sales), Dish Network (18%), Time Warner (12%), and Charter (10%), although with the Intec acquisition these percentages are expected to decline over time. CSG has historically been successful in renewing contracts, and last year extended its contract with Dish Network in part through 2017. Even so, the degree of concentration of customers is a risk factor that should not be ignored. The Comcast contract in particular expires at the end of 2012. The Comcast contract was last extended in 2008 for four years. The contract with Time Warner expires in March 2013, and the contract with Charter Communications expires at the end of 2014.

Turning now to the figures, I mentioned earlier that the company has an excess cash position. I calculate excess cash as total cash and investments minus the extent to which current liabilities are uncovered by noncash current assets. According to its latest balance sheet, CSG Systems has $167 million in cash and investments, $195 million in tangible current assets (consisting of accounts receivable and income taxes receivable), and $209 million in current liabilities. As a result, the company has $153 million in excess cash. Subtracting that figure from CSG’s market cap of $585 million as of this writing, we get a figure of $432 million for the market value of the company’s operating assets.

In terms of earnings, I spoke earlier of certain nonrecurring expenses that I will be adjusting for. These would be $12 million in charges relating to the acquisition of Intec, and $20.5 million relating to the company switching its data center to a new provider. The data center switch also produced $15.5 million in expenses in 2009.

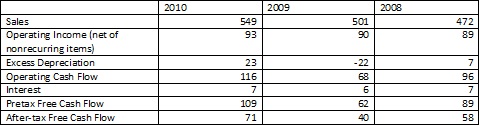

So, in 2010, revenues were $549 million, operating earnings were $74 million, but reversing the above nonrecurring charges and taking into account a $14 million foreign currency loss brings the figure to $93 million. The company also incurred $23 million in excess depreciation. This produces a total free cash flow from operations of $116 million. Interest expense that year was $7 million (although CSG Systems did issue a significant amount of debt relating to the Intec purchase, so future interest expenses will be higher). This produces pretax free cash flows of $109 million, which, at a 35% tax rate, produces an after-tax cash flow of $71 million. Based on the above figure of $432 million for the market value of the company’s capital assets, that produces a free cash flow yield of 16.4%, which I consider very attractive.

I should note that this figure differs from the company’s reported earnings for 2010 primarily owing to the noncash amortization of the company’s convertible bond issue, a loss taken on bond repurchases, the company’s interest income, and of course the nonrecurring expenses previously mentioned. However, it is what I consider to be a more reasonable estimate of the company’s sustainable earnings power.

The first quarter of 2011 is shaping up well. Sales were $183 million, operating income was $24 million, excess depreciation and amortization was $10 million, producing $34 million in operating cash flow. Interest expense were $4.3 million, leaving $29.5 million in pre-tax free cash flow, or $19 million in after-tax free cash flow. Obviously, one should not make too much of a single quarter’s earnings, but CSG Systems is not a seasonal company and this figure is at least consistent with (higher than, actually) the company’s historical ability to generate free cash flows.

In terms of debt, the company has outstanding $197.5 million in term loans at LIBOR plus 3.75% due 2015, $150 million in 3% convertible loans due 2017, and $25.2 million in 2.5% convertible loans due 2024. The conversion price for the 2017 loans is $24.45 and for the 2024 loans it is $26.77. As we have seen, interest is covered by cash flows nearly eight times based on the first quarter of 2011’s results and therefore the debt looks fairly safe. The price of CSG Systems as of this writing is $17.88. However, if we apply a 10x multiple to the company’s earnings, and estimate earnings power at $70 million based on the 2010 figures, we get a value for the firm of $853 million ($700 million for the earnings power plus $153 million in excess cash). Based on the 32.9 million fully diluted shares, this translates to a price of $25.89, so there may be some dilution from at least the 2017 bonds.

CSG Systems reports second quarter 2011 earnings on August 2. Analysts are estimating that earnings will be 55 cents, marginally better than last year’s second quarter earnings of 53 cents. I will not comment on analyst estimates, but it is probably worth keeping track of the date.

So, with CSG Systems we have a company with strong earnings power that has the stability of long-term contracts behind it. The customer concentration is a risk factor, although the Intec acquisition has diversified the company’s revenue sources. As long as the company is capable of renewing its major contracts I anticipate that is earnings power will continue, and as it trades at a remarkably low multiple to free cash flow, I can strongly recommend CSG Systems as a candidate for portfolio inclusion.

Leave a Reply