Cablevision: Reasonably Priced with Substantial Free Cash Flow

I have long been attracted to companies with a high level of free cash flow, and I have found that telephone companies have been a fruitful place to look, as the companies combine a cash flow orientation with a recurrent source of income. And I think cable companies may have similar investment characteristics. There is something to be said for a company that requires an affirmative action from its customers in order to stop receiving service. After all, when I cancelled my cable service it was because I realized that it had been months since I actually watched TV.

My attention was recently drawn to Cablevision (CVC), a company with about 3.25 million customers in the New York City area. The company also offers high speed Internet and VoIP. The company has also recently acquired Bresnan Cable, a firm which supplies several regions in the foothills of the Rocky Mountains. This acquisition was funded through the issuance of debt and improved the 2011 results significantly as compared to 2010. The company’s debt load, although significant, gives every impression of being manageable. Cablevision’s New York operations showed flat or very slight growth as well in 2011.

My attention was recently drawn to Cablevision (CVC), a company with about 3.25 million customers in the New York City area. The company also offers high speed Internet and VoIP. The company has also recently acquired Bresnan Cable, a firm which supplies several regions in the foothills of the Rocky Mountains. This acquisition was funded through the issuance of debt and improved the 2011 results significantly as compared to 2010. The company’s debt load, although significant, gives every impression of being manageable. Cablevision’s New York operations showed flat or very slight growth as well in 2011.

Cablevision also owns non-cable operations such as a newspaper company, a chain of movie theaters, and a high school sports network. In my opinion these other assets should be divested, as the newspaper company is paying an interest rate of 10%, while the management admitted in their latest conference call that the movie theater chain had a negative EBITDA once the contributions to corporate-level expenses were taken into account. Since a positive EBITDA is just about the lowest hurdle a company should be capable of clearing, the grounds for disposal seem pretty clear.

There is speculation is that Cablevision is trying to position itself to be acquired, and the company has in the last two years spun off Madison Square Garden, Inc., and AMC Networks, a collection of cable channels. Some observes believe that the reasons for the spinoffs were in order to make Cablevision a pure cable company that would be a better “strategic fit.” However, this rumor has been floating around for some months now, and in my view the possibility of a takeover should be a bonus, not the sole reason for investing. However, the company also owns more than 21 million shares of Comcast, which it claims to have received as the result of various transactions. The company has fully hedged this position with futures, but one wonders if the shares serve a strategic purpose.

I should point out before addressing the figures that the company has two series of shares outstanding. There are 217 million class A shares outstanding that are publicly traded and entitled to one vote, and 54 million class B shares that are held by the controlling family and entitled to ten votes. The class B shares are not publicly traded, but may be converted into class A shares on a 1:1 basis.

The company has about $5.2 billion in bank debt, which bears interest rates of a little over 3% on a weighted average basis, not counting the newspaper’s debt I referred to above. However, these debts come with an extension fee of between 2 and 2.5% per year. There are is also $5.4 billion in notes that have an average interest rate of roughly 8%. However, in the previous year the company refinanced some of its notes at 6.75%. The company’s overall interest rate on its long term debt would be 6.9% based on its first quarter 2012 interest expense, and so it is not evident that the market is punishing Cablevision for its high debt load.

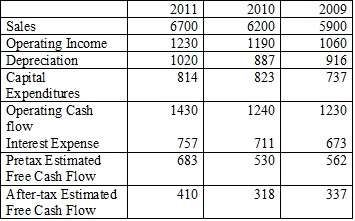

In 2011, sales were $6.7 billion, operating income was $1.23 billion, depreciation was $1.02 billion, and capital expenditures were $814 million, producing $1.43 billion in operating cash flow. Interest expense was $757 million, leaving $683 million in pretax cash flow, or $410 million in estimated after-tax free cash flow, with a tax rate of 40%. All figures are calculated without taking into account changes in working capital

In 2010, sales were $6.2 billion, operating income was $1.19 billion, depreciation was $887 million and capital expenditures were $823 million, producing $1.24 billion in operating cash flow. Interest expense was $711 million, leaving $530 million in pretax estimated free cash flow, or $318 million. I should point out here that this was the year of the Bresnan acquisition, but the company estimates that even setting aside the acquisition, revenues were up 1.2% and operating income was up 2.1%. It is also noteable that the interest coverage ratio based on operating income has barely moved despite the debt-funded acquisition, while free cash flows have improved considerably.

In 2009, sales were $5.9 billion, operating income was $1.06 billion, depreciation was $916 million, capital expenditures were $737 million, producing $1.23 in operating cash flow. Interest expense was $673 million, leaving $562 million in pre-tax cash flow, or $337 million after taxes.

However, in the first quarter of 2012 sales were $1.66 billion, as compared to $1.65 billion in the first quarter of 2011, operating income of $250 as compared to $298, depreciation of $253 versus $243, capital expenditures of $216 versus $131, producing $287 in operating cash flow versus $412. Interest expense was $182 million versus $191 million, producing $105 million in pretax cash flow, or $63 million after estimated taxes versus $221 and $133 million, respectively.

Cablevision’s has explained the decline in operating income as being largely due to increased operating expenses, specifically $25 million in programming costs, $15 million in operations and network-related costs owing to increased network and customer premises maintenance expenses, and $6.5 million in VoIP-related matters, of which $3 million was an arguably nonrecurring settlement with the New York sales tax authorities. These three factors add up to $46.5 million and make up virtually all the gap in operating income between $250 million and $298 million in the first quarter last year. I should also point out that programming costs are generally charged on a per-subscriber basis, so these are variable costs that can be passed on to customers.

As for the increase in capital expenditures, Cablevision’s management explained during its first quarter 2012 conference call that the purpose of the expenditures was to make key network upgrades and to support their networked DVR system, and that some of the expenditures were for future projects that had been accelerated. However, they also stated that the increased capital spending will probably continue through 2012, although they did not state at what level. I am hopeful that the newly efficient network should reduce operating expenses in future years. In the conference call management also revealed that the company had not thus far announced a rate increase in 2012, which allowed the company to slightly increase its subscriber count but which left revenue relatively flat. So it is not clear to what extent a future rate increase would hamper Cablevision’s customer retention efforts.

The company offers a dividend yield of 4.5% based on current prices and has raised the dividend twice in the last two years by a total of 50%. Cablevision also disclosed in its conference call that it could have further increased the dividend this year, but declined to do so. Even so, management has increased its repurchase authorization and repurchased an additional $49 million, or roughly 1.4% of outstanding shares, in the first quarter. As I’ve said, I’m not that convinced about the wisdom of buybacks as a means of creating value.

So, in terms of valuation, Cablevision is, as I said, controlled by the class B shares. The customary method of handling this is to assign these shares a control premium, which normally ranges between 20 and 50%. I think 30% is a useful estimate. Thus, the 54 million class B shares should count as 70 million in computing relative share weights. Therefore, the remaining 214 million class A shares should have an effective claim of 75.3% of the company.

If I had to estimate the company’s earnings power based on free cash flows, I would assume that in the near future the company would at least make some attempt to pass on the increased programming costs on to the customers and that the rate increase may have been deferred this year but should occur eventually. Also, I am convinced that at least some of the incremental capital expenditures were based on the acceleration of future projects and so the current expenditure level is higher than would ordinarily be required to maintain Cablevision’s earnings power. As a result, we could split the difference between 2011 and 2012 so far, and estimate the company’s earnings power at roughly $400 million in free cash flow per year. But even as I write this paragraph, I am aware that sound value investing should not rest on too any assumptions, and that a key difference between a value investment and an attractive speculation is the lack of conditional statements. So I do not deny that this stock may not qualify as a pure value play at current prices.

Even so, $400 million per year, capitalized at 10x, would support a value of $4 billion, or $3.01 billion to the class A shares based on the control premium. Based on the current price of $13.25, the current market value of the class A shares is $2.84 billion. So there is a slight upside based on the current earnings power, and a future rate increase would serve to increase that upside.

Therefore, I can say that Cablevision, although perhaps not a pure value play, is a fairly-priced company that offers a reasonably substantial prospect of significant free cash flow generation, and should be a candidate for portfolio inclusion, especially if the share price should fall further.

Leave a Reply